Improving access to funding

CFO Pulse Survey results

Access to funding is crucial for driving business growth, yet CFOs continue to face challenges as a result of economic challenges and shifting investor expectations. George Fieldhouse, Partner and Head of Debt Advisory, explores how finance leaders can build lender confidence in a competitive market.

The debt financing market has tightened over the past few years due to inflation and concerns over company profit margins and cash generation. The volume of new debt deals decreased, as did the available debt per deal, and terms became less favourable.

While borrowing is still constrained by high base rates, lenders started cautiously re-entering the market from mid-2023, offering more competitive terms and increased flexibility. This 2023 recovery has accelerated in 2024 and we’ve seen a significant increase in the appetite from lenders to put forward terms.

However, borrowing is still constrained by high base rates - and nearly a third of the CFOs we surveyed cited limited availability of credit options (34%), more stringent lending criteria (32%), changes in high street lenders' risk appetite (32%) and high interest rates (32%) as the most significant challenges they anticipate they will continue to face in securing access to capital.

What actions can CFOs take?

1 Build relationships with lenders early

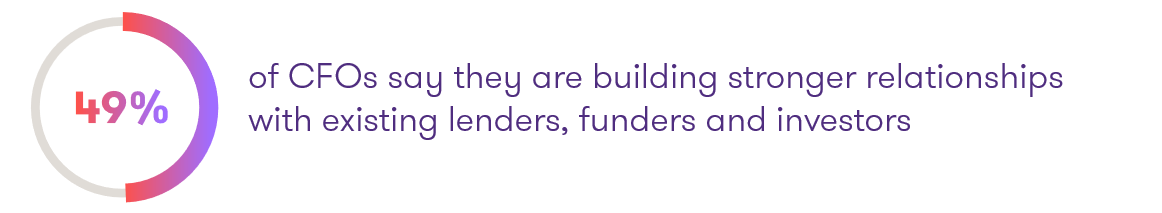

Engaging more regularly and thoroughly with lenders beyond minimum obligations is crucial for securing favourable terms in a competitive market.

The more you meet with your point of contact and provide them with deeper insights into your business and its leadership, the better they can deliver comprehensive updates and address potential concerns raised by their central credit team as the lender monitors your business’s performance.

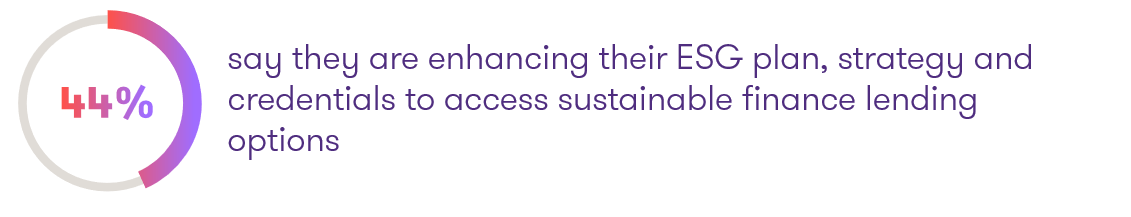

2 Focus on your ESG credentials

Sustainability credentials are likely to have an increasing bearing on credit availability and pricing. Our recent survey of nearly 50 UK-based lenders confirmed this, with 73% of lenders saying they now have an ESG lending strategy in place, compared to only 57% in 2022.

Although only 15% of the CFOs we surveyed said that they currently ‘have dedicated resources and processes in place to proactively address ESG regulations’, 44% confirmed that they to enhance their ‘ESG plan, strategy and credentials’ to access sustainable finance lending options.

Initial public offering: an alternative route to capital

An initial public offering (IPO) can provide significant capital for growth, as well as raising your profile and incentivising people in the business to drive performance. But, it isn’t the right path for every business. Public companies need to deal with investor pressure to meet growth expectations, heightened legal risk, and an increased regulatory burden.

Consulting with financial advisers can help determine whether an IPO aligns with your company's strategic objectives – and if it does, to support you on the road to IPO readiness.

3 Consider alternative sources of lending

There are a lot of options available for different borrowers. In addition to the banks available, there are a huge number of debt funds that can offer a range of different types of debt structures and options.

This is key in the current environment, as a lot of businesses come to refinance and find that the deal they did three years ago with a bank at a certain leverage is no longer available to them with that same lender. Debt funds allow for an alternative risk appetite – enabling businesses to be potentially get a similar quantum of debt as before, although likely at the cost of higher interest rates.

4 Prepare reliable forecasts

Finance teams need a robust operational model that accurately reflects historical performance and forecasts future outcomes, as well as accurate and clean core financial data. A strong financial foundation will build lender confidence, allowing you to secure more favourable terms.

For more insight on this topic, reach out to Head of Debt Advisory George Fieldhouse.

Take a look at the full results of our CFO Pulse Survey, covering digital transformation, AI, finance business partnering, access to funding and more.

Read more deep dives from the CFO Pulse Survey

Risks and rewards of AI integration: CFO Pulse Survey results

AI adoption shows no signs of slowing down. Find out how CFOs can balance the risks and rewards of AI.

Uncovering the challenges of digital transformation: CFO Pulse Survey results

Most finance leaders are planning a digital transformation initiative. Learn how CFOs can launch these successfully.

Elevating finance business partnering: CFO Pulse Survey results

There's more demand for finance leaders to create value throughout the business. How can finance business partnering help?

Attracting talent from the evolving workforce: CFO Pulse Survey results

We uncovered concerns about meeting changing employee expectations. Learn how CFOs can attract and nurture the talent they need.