How can construction firms, housebuilders, developers and their respective lenders work through the UK cladding crisis, in an environment of rising inflation and labour shortages? Christopher McLean and Rob Parker explain how you can approach these challenges.

We are seeing the continuing impact of the cladding crisis on the construction and housebuilding sectors. General provisions relating to cladding are being converted into specific and larger provisions since the beginning of the year. The government announced on 13 April 2022 a wide-ranging agreement that will see the sector contribute £5 billion to address the safety crisis. This situation is putting additional liquidity and lending pressure on borrowers and lenders, which must be urgently addressed.

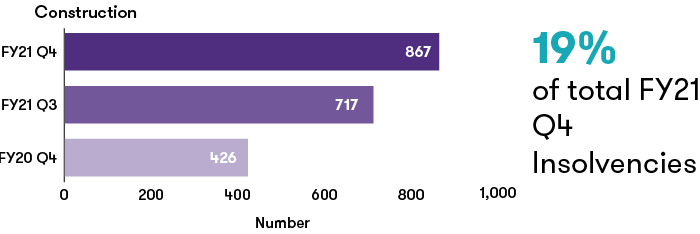

The cladding crisis is forcing some borrowers to seek covenant resets with their lenders and other financial stakeholders including surety providers. Not all of them will be able to comfortably fund these provisions if or when they crystallise into current liabilities. Combined with cost price inflation through the supply chain, these headwinds are impacting firms of all sizes. In Q4 2021, insolvencies in the construction sector more than doubled from the same period in the prior year and accounted for 19% of total insolvencies in the UK during this period – the largest sector for insolvencies across the UK economy.

Further reading: the cladding crisis

Do you have questions about the government's response to the cladding crisis, and regulator's expectations of firms? You can get insight on these issues from our expert teams.

On 12 April 2022, 36 developers signed a pledge committing to remediate life-critical fire safety works in buildings over 11 metres tall that they have played a role in developing or refurbishing in England over the last 30 years. The developers pledged to spend a minimum of £2 billion, doubling their initial commitment. The government also announced a new scheme funded through an extension to the “building safety levy” that would raise up to an additional estimated £3 billion during the next decade. This new levy will be charged on all new residential developments in England.

Developers have committed to act as quickly as possible to fix buildings. Among following new guidelines on building safety, they will also refund money already received from the taxpayer to repair their buildings.

For the companies yet to pledge, the government plans to enforce in law new powers to block those who refuse to sign from building and selling new homes. The government already imposed a March 2022 deadline on the residential property developer and construction products manufacturing industries to agree a fully-funded plan of action to rectify buildings containing unsafe cladding.

The requirement was that developers and manufacturers, who have i) assisted in developing buildings that have aluminium composite material (ACM) cladding and ii) provided materials to buildings 11 to 18 meters tall, make a voluntary financial contribution to a dedicated fund. This fund is in addition to the £5.1 billion Building Safety Fund, which covers cladding remediation in buildings 18 or above meters tall. The Housing, Communities and Local Government Committee estimated that the full cost of all fire safety remediation works could be up to £15 billion.

On 13 April 2022, the government also wrote to the Construction Products Association to demand manufacturers to commit to the solution.

After the Grenfell fire, the Ministry of Housing, Communities, and Local Government (now called the Department for Levelling Up, Housing and Communities) established the Building Safety Programme. This scheme identified 481 high-rise buildings across the UK that used unsafe cladding and widespread non-compliance with fire-safety building requirements.

The government originated the Building Safety Bill in 2021 which aims to amend the Architect Act 1997. It will be the new regulatory framework for building safety and includes the creation of a new Building Safety Regulator for high-rise buildings.

Amendments to the Building Safety Bill have extended the legal right of building owners and leaseholders to demand compensation from their building’s developer and cladding companies for safety defects up to 30 years old. The Bill currently covers sub-standard construction defects up to 15 years from the current six years period. This will add additional pressure to developers’ and cladding companies’ provisions.

The costs of remedying safety defects, including unsafe cladding, will have to be met by developers and manufacturers. Secretary of State for Levelling Up, Michael Gove, has requested that the industry announces a partly funded plan of action.

The secretary warns that the government should take all steps necessary to make this happen, including:

- restricting access to government funding and future procurements

- blocking planning permission and building control sign-off to prevent firms from building and selling new homes

- charging developers a higher rate of the new building safety levy

- using cost contribution orders to ensure manufacturers prosecuted for selling unsafe cladding pay their fair share

- preventing developers from setting up shell companies to oversee individual blocks to avoid future liability.

The secretary adds that if the industry fails to take responsibility, the government will impose a solution through the Building Safety Bill, which is scheduled to pass into law within the next few months according to the Department for Levelling Up, Housing & Communities.

Since the UK government announced the new approach on 10 January 2022, the total market capitalisation of FTSE 350 house builders has decreased by £10.2 billion or 25.2%.

Michael Gove also asked the Financial Conduct Authority to review the buildings insurance market for multiple-occupancy residential buildings, in close consultation with the Competition and Markets Authority (CMA). Insurance premiums have increased considerably for almost all leaseholders in blocks of flats, and some insurers are unwilling to offer new policies for buildings with unsafe cladding.

The impact of cladding on the UK housing and construction sector was being felt in 2021 and is intensifying in 2022. However, remedying cladding is not the only issue confronting the sector and may not even be a key concern for many firms; the continued difficulties in terms of material costs, delays in the supply chain and labour shortages are creating strong headwinds, as evidenced by the rising number of insolvencies. We are actively working with companies and lenders across a range of issues in these sectors and please do not hesitate contact us if you would like to discuss any of the points raised in this article.

Christopher McLean, Partner, Debt Advisory and Restructuring

“Being on the front-foot by presenting the solution to your stakeholders, in a transparent and credible way, is key to ensuring the best outcome. Pre-empt questions and likely data requests. Preparation is vital to ensure companies stay in control of what can be difficult discussions, in what is an increasingly difficult economic environment”.

Rob Parker, Director, Restructuring

“Information is always key when faced with the challenging headwinds currently seen in the sector and robustly modelling the impact on profitability and, more importantly, cash flow is essential to enable management teams to keep business plans on track and to engage properly with key stakeholders, such as customers and funders”.

![]()