Pension scheme stakeholders need to understand a scheme’s access to value, how this might change over time and as a result of employer events.

Why Grant Thornton

You'll be supported by a specialist team who have performed many valuations for schemes and employers in the context of transactions, restructuring, covenant reviews, asset-backed funding, regulatory powers, and financial reporting.

We coordinate seamlessly with covenant advisers, pensions lawyers, independent trustees, the Pensions Regulator, and the Pension Protection Fund in delivering independent valuation advice.

We bring focused industry expertise to understand the medium to longer term value drivers impacting scheme employers and their sustainability.

Our specialists are fully integrated into our wider pensions advisory service-advising over 50 schemes with assets in excess of £1 billion.

Business and asset valuations for pension scheme stakeholders

Business and asset valuation issues are common challenges faced by pension scheme stakeholders.

Watch this video to discover how our team can support you with expert advice and independent valuations across a variety of scenarios – transactions/restructuring, covenant strength, regulatory purposes, asset -backed funding, illiquid assets – and the benefits this can provide.

Uncover our examples below of how we can support you with our valuations expertise.

Transactions and restructuring

Access to value pre/post and estimated outcomes

We help trustees and employers consider the value impact of transactions and restructuring on scheme covenant – providing valuation inputs to entity priority models (EPM) allowing comparison of before and after creditor returns.

Our valuations analysis provides comfort to schemes that the covenant hasn’t materially changed as a result of the transaction. We can also support analysis of mitigating actions (such as a one-off contribution) to ensure that the scheme isn’t worse off than it was prior to the transaction.

When considering these factors in a potential insolvency scenario, our combined valuation and modelling team can build and run complex entity priority models to demonstrate the potential returns to different creditor groups (including the scheme), from various insolvency scenarios.

Covenant reviews

Employer covenant valuations

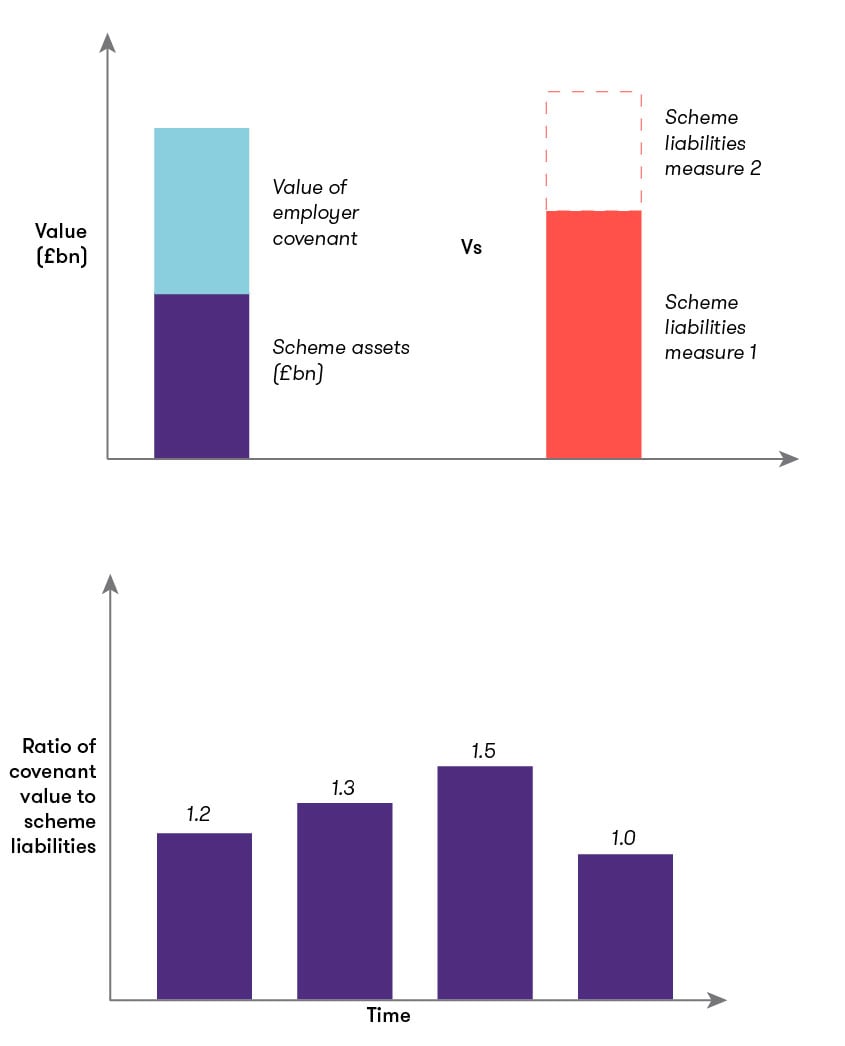

Valuations analysis enables us to support companies and trustees with covenant assessments. Valuation analysis provides an additional quantitative measure of covenant strength and explicitly illustrates the impact of different business and macroeconomic scenarios on covenants.

We perform valuation analysis in support of covenant assessments, either on a stand-alone basis, or as a supplement to more traditional “traffic light” covenant assessments.

A discounted cash flow (DCF) approach:

- provides a quantitative assessment to supplement more qualitative covenant methodologies

- can model medium to longer term macroeconomic, market, and employer specific cash flow assumptions

- directly shows the impact of different forecast scenarios and sensitivities

- can be measured consistently over time, and thresholds in relation to deficit measures can easily be set to trigger particular courses of mitigating action.

Regulator's powers

Financial support directions

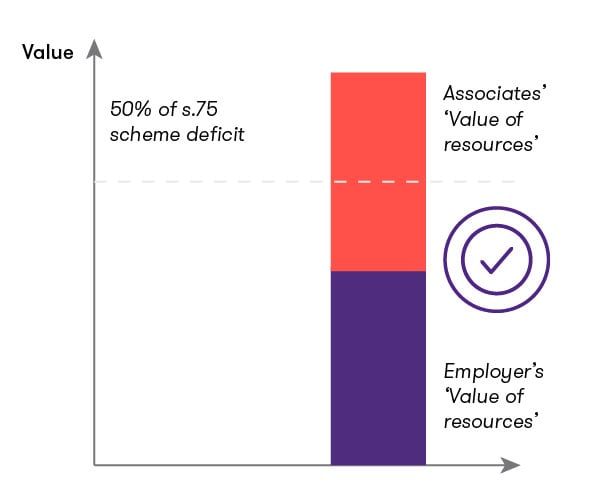

We have wide-ranging experience of valuation tests, including the insufficiently resourced test (IR test) under financial support direction (FSD) legislation. Our teams can both perform the analysis and provide an independent expert opinion on the outcome, or assess the likelihood of being deemed "insufficiently resourced".

The IR test is a three-stage valuation test. It assesses whether the employer is under-resourced, and then if there are other associated entities in its group whose resources, when combined with the employer’s, are sufficient to support the scheme.

We can work closely with schemes, the Pensions Regulator and their respective legal advisers to:

- interpret the relevant legislation from a valuation perspective

- perform the IR test

- draft an expert valuation report.

We can support employers or schemes, using our specialist knowledge to quickly assess whether an employer is insufficiently resourced.

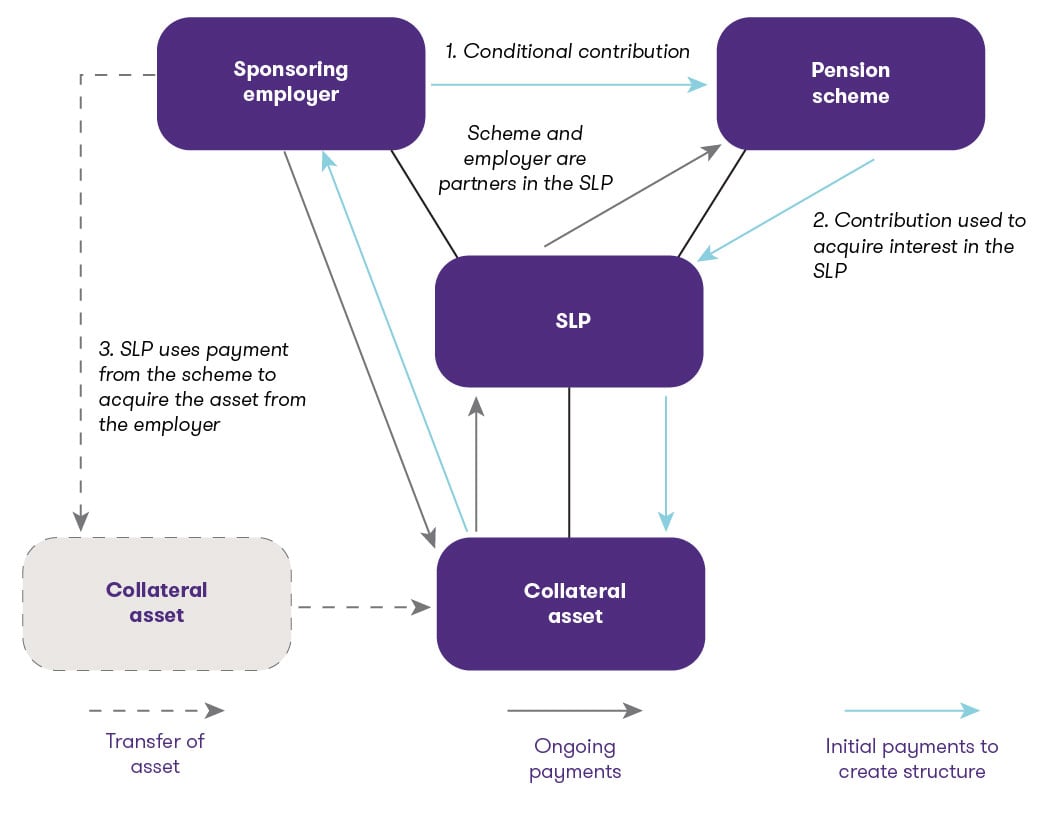

Asset-backed funding

Scheme interest and collateral asset valuations

Asset-backed funding solutions cover a wide range of collateral assets, from property to intangibles, such as brands and contracts. We can provide valuations at inception, for ongoing reporting and for PPF levy purposes.

Asset-backed funding has many advantages for both schemes and employers. However, once outside the realm of the more typical property assets, the collateral can be challenging to value and requires expert assessment.

This is how we can support employers:

- Assess the feasibility of different asset types, including intellectual property and other intangibles

- Run preliminary valuation assessments

- Perform valuations for PPF levy-purposes

- Independent valuation of the scheme asset/collateral at inception and on a periodic basis for financial reporting

- Test the sensitivity of the valuation to different distress scenarios

- Advise on the practical aspects of realising value in an insolvency situation

Financial reporting

Periodic valuations for financial reporting

As an independent valuer we can offer regular valuations of unlisted scheme assets: defensible fair value outputs for audit and other reporting and governance processes.

Our market leading infrastructure valuations team brings a wealth of experience in global valuations of infrastructure assets and portfolios. We provide independent valuations for transactional and financial reporting purposes to a wide variety of private equity and infrastructure funds, institutional investors, corporates, sovereign wealth funds, and pension schemes.

Transactional valuations

Valuing projects and portfolios of listed and private equity and debt investments across the renewable energy sector to assist investment committees.

Model reviews

Supporting deals by reviewing deal models for financial close.

Fairness opinions

Public prospectus fairness opinions in relation to seed-asset portfolios for IPOs.

Model build

Creating models and building sensitivities at asset level and at fund/portfolio level.

Process automation

Using VBA to automate repetitive manual tasks and improve process efficiency.

Interactive dashboard tool to present key performance data from portfolio models to aid periodic reporting.

Model updates

Outsourced model updates from asset-level to fund-level to free up transaction teams around reporting periods.

Periodic valuations

Independent asset and portfolio periodic valuation reports or letters as an independent valuer endorsing defensible outputs for your audit processes.

![]()